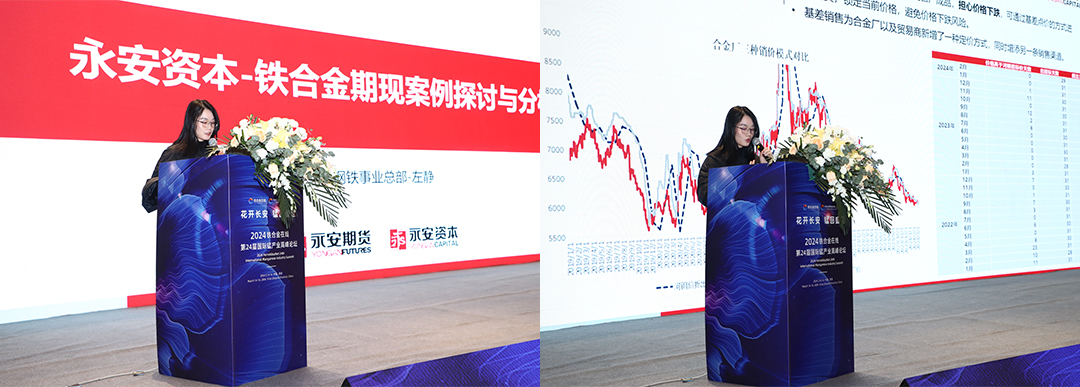

www.ferroalloynet.com: Zuo Jing, Futures & Spots Manager from Yongan Capital Steel Business Headquarters brought "Discussion and Analysis of Ferroalloy Futures Cases" to this summit. Ms. Zuo Jing briefly introduced the development of Yongan Capital firstly. The report mentioned that the company's steel market covers East China, Chengdu and Chongqing, Wuhan, Xi'an, Zhengzhou, Beijing-Tianjin-Hebei and other regions, while the raw material markets are located in Ningxia, Inner Mongolia, Henan, Qinghai and Beijing-Tianjin-Hebei and other regions. And a detailed analysis was conducted on the risk management of the industrial chain: upstream--alloy factories; midstream--traders; terminal--steel mills, etc.

In-depth discussion of individual cases of ferroalloy futures, and explanation of futures business cooperation models. Several cooperation models of futures business are explained in detail:

1. Basis spread: The quotation consists of the futures price plus the agreed basis. The benchmark price can be freely selected during the pricing period.

2. Factory warehouse services: off-site factory warehouse services: factory warehouse purchase and delivery, factory warehouse terminal distribution, factory warehouse delivery on behalf of others.

3. Warehouse receipt services and multi-dimensional warehouse receipt services: purchase and sale of warehouse receipts, exchange of warehouse receipts, EFP, warehouse receipt pledge.

4. Delay the price point: pay for delivery at the tentative price, and separate the logistics and price flow for subsequent price point settlement.

5. Inventory management: meet customer wheel inventory needs, trade in old items for new ones.

6. Fixed structure pricing: prices match different settlement methods within different ranges, and customized risk management services.